Property

← Back to Resources-

MTD for freelancers: what you actually need to do (step by step)

Ok, being honest here, the number one question we get asked is basically:

-

2026 Landlord mini-update (for freelancers with “a rental on the side”) 🏡

So here’s what matters in 2026: Landlord Financial Planning Edition

-

Mortgage Interest: What Landlords Can (and Can’t) Claim

Most of our clients aren’t full-time landlords. You might be renting out a flat you used to live in, or letting a property for some extra income. If that’s you, here’s a straightforward guide to what mortgage interest you can claim against your rental income.

-

Holiday Lets – relief for finance and investment costs from April 2025

Unincorporated landlords letting furnished holiday accommodation will obtain relief for their interest and finance costs from April 2025 after the favourable tax regime for furnished holiday lets has come to an end

-

Making Tax Digital: Is it Really Happening This Time?

This is the first in a series of updates for Making Tax Digital (MTD)

-

Making the Most of Your £1,000 Property Allowance: A Landlord's Guide

The UK government offers a £1,000 property allowance, meaning you don't need to pay tax on that income or even declare it to HMRC

-

The Double Take: Tax "Hacks" from TikTok Influencers and the Perilous Pitfalls

Scroll through any social media platform these days, and you're bound to stumble upon "finance influencers" peddling their secret tax-saving strategies.

-

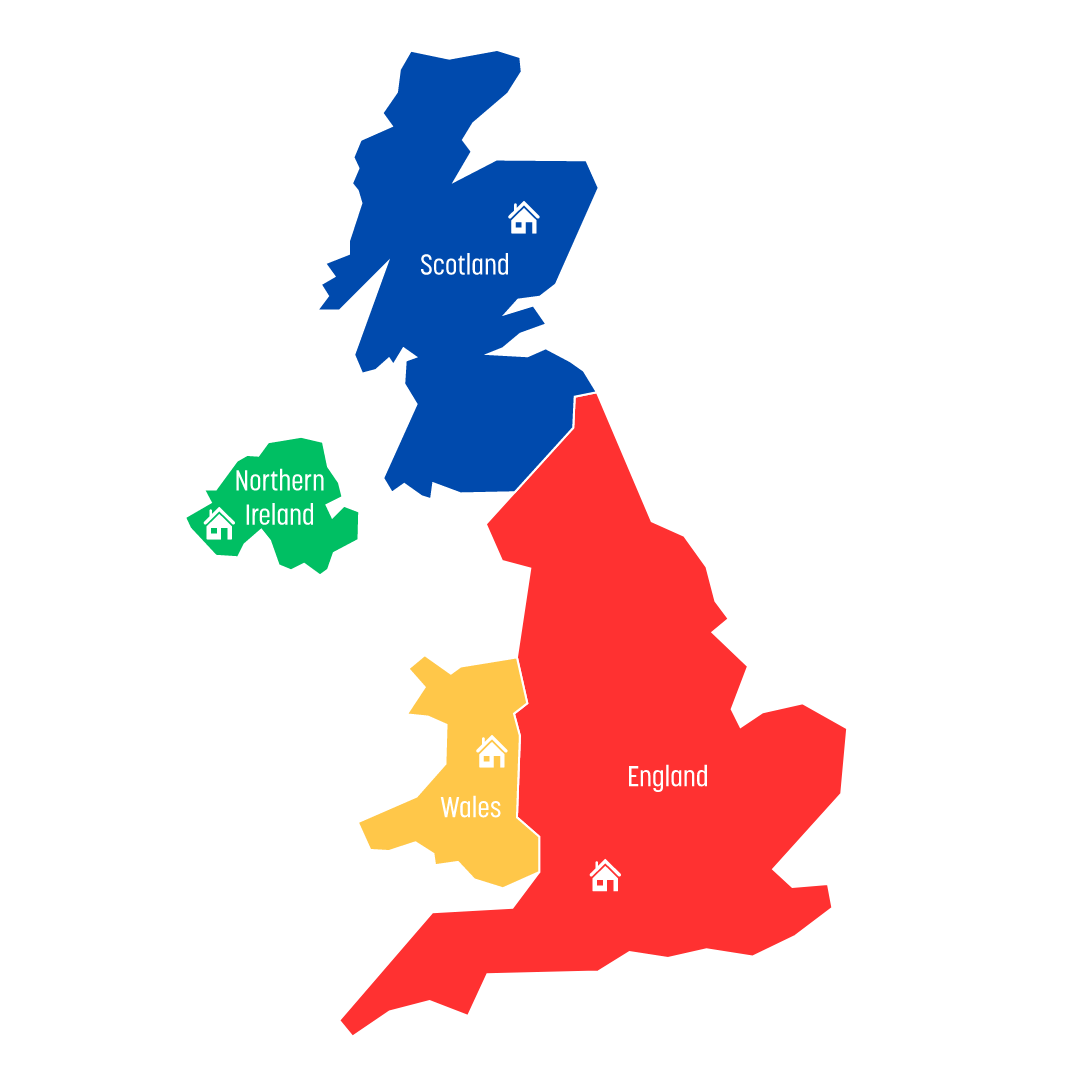

SDLT, LBTT and LTT hit of buying an investment property

Where a property is purchased in England or Northern Ireland and the consideration exceeds the relevant threshold, stamp duty land tax will be payable.