-

Launching Your Business Without Breaking the Bank: Claiming Pre-Trading Expenses

Starting a business is exciting, but it can also come with a mountain of pre-launch expenses.

-

Don't Let Losses Drag You Down: Tax Relief for Freelancers & Small Businesses

Running your own show is rewarding, but sometimes even the most dedicated entrepreneurs face a tough year.

-

Freelancers: Can You Write Off Meals with Clients?

Running your own business means keeping costs down.

-

Good News for Self-Employed Training Costs!

Just starting your own business? Great decision! As a new freelancer or sole trader, you might be wondering if you can claim tax relief for training courses.

-

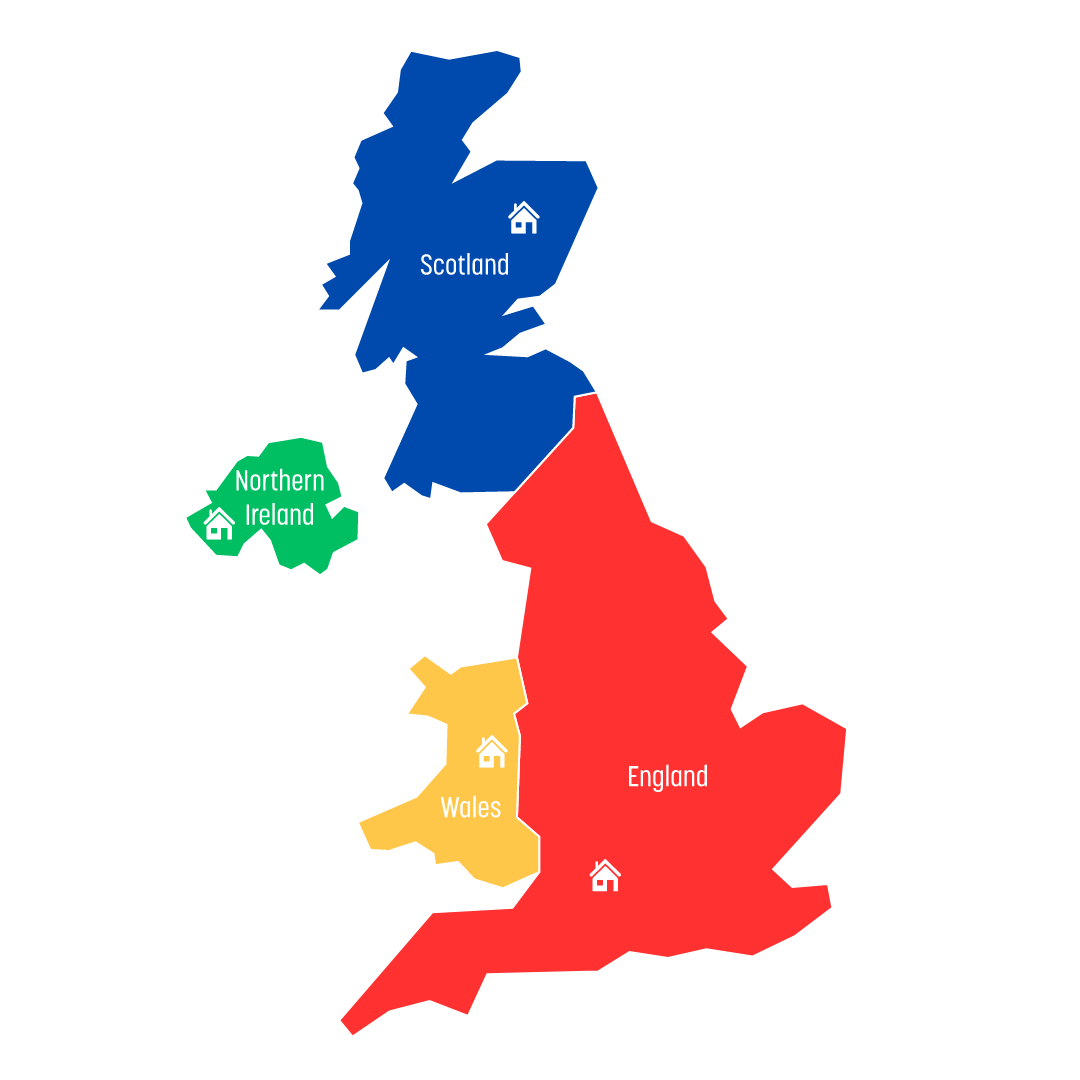

Income Tax Rates and Allowances for 2024/25 (UK)

Here's a breakdown of income tax rates and allowances for residents across the UK:

-

Drumroll please... It's Tax Season 2024!

Don't let the filing frenzy faze you. Get ready with us!

-

The Double Take: Tax "Hacks" from TikTok Influencers and the Perilous Pitfalls

Scroll through any social media platform these days, and you're bound to stumble upon "finance influencers" peddling their secret tax-saving strategies.

-

Navigating the Labyrinth of Insurance Premiums: Why Freelancers, the Self-Employed, and New Business Owners Face Higher Costs

In the dynamic world of work, the rise of freelancing, self-employment, and new business ventures has transformed the professional landscape.

-

Separating couples with children and child benefit: What you need to know

If you and your partner are separating, you need to decide who will continue to claim child benefit.

-

The Online Sell-Off: HMRC Cracks Down, But Is It Fair Play?

HMRC's recent move to require online platforms like eBay and Vinted to report seller information has stirred a hornet's nest.