Resources

Categories

-

Don't Let Losses Drag You Down: Tax Relief for Freelancers & Small Businesses

Running your own show is rewarding, but sometimes even the most dedicated entrepreneurs face a tough year.

-

New VAT Rules for Voluntary Carbon Credits: Impact on Self-Employed and Small Businesses

HMRC is changing the way Value Added Tax (VAT) applies to voluntary carbon credits (VCCs) starting September 1, 2024.

-

Freelancers: Can You Write Off Meals with Clients?

Running your own business means keeping costs down.

-

Confusing VAT Rules for Builders and Subcontractors: Simplified!

This is a special VAT rule where the customer pays the VAT instead of the business.

-

Lost Years, Lost Credit: Why Registering for Child Benefit Matters

A recent scandal has revealed a hidden pitfall for parents who choose not to claim child benefit: potential loss of state pension credit in retirement.

-

Good News for Self-Employed Training Costs!

Just starting your own business? Great decision! As a new freelancer or sole trader, you might be wondering if you can claim tax relief for training courses.

-

Changes to Child Benefit for Higher Earners: What You Need to Know

Are you a family getting Child Benefit and one partner earns a good income?

-

Saving your Money Tax-Free: A Simple Guide to ISAs

Are you saving money and worried about paying tax on the interest you earn? You're not alone! With rising interest rates, more people are finding their savings pushed above the tax-free limit.

-

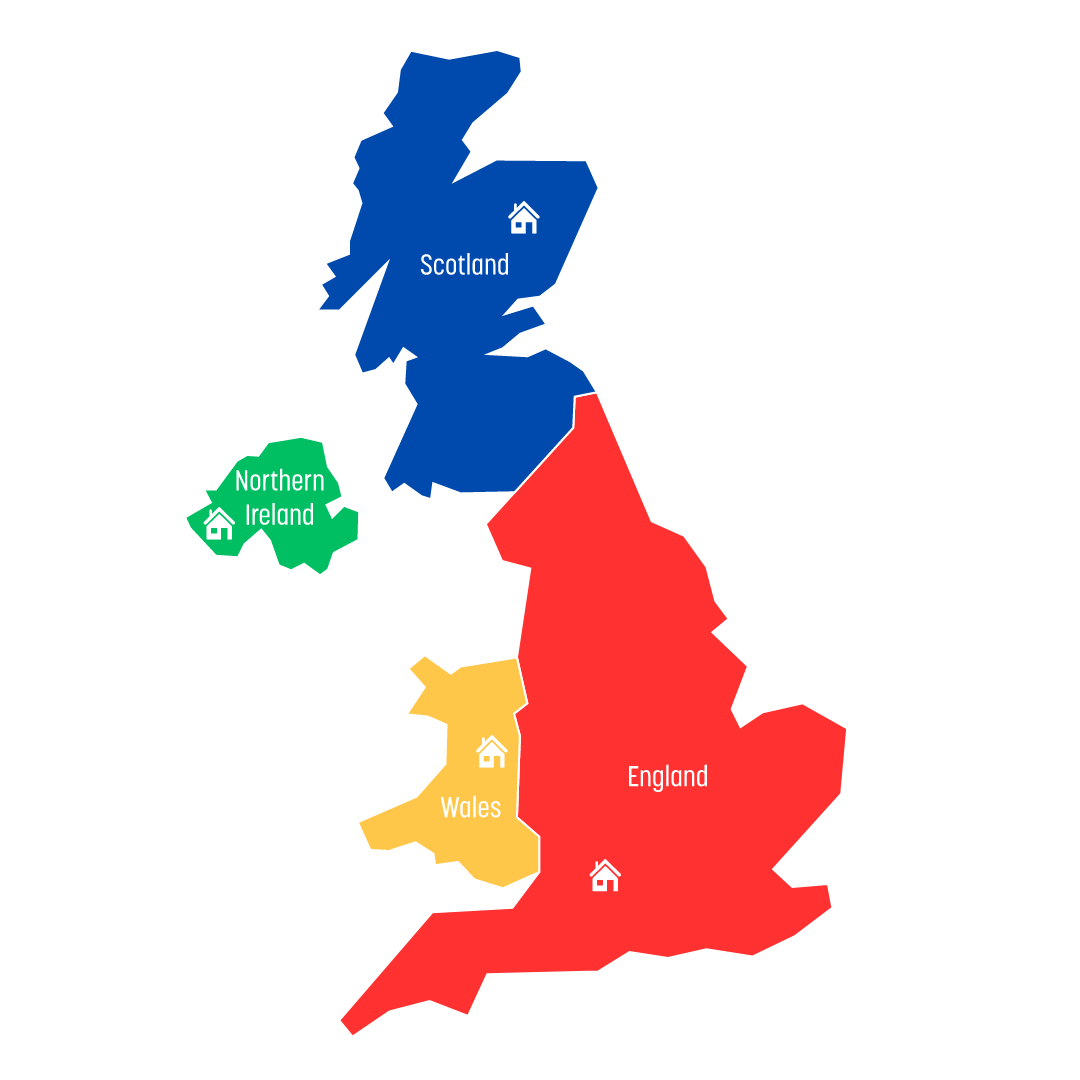

Income Tax Rates and Allowances for 2024/25 (UK)

Here's a breakdown of income tax rates and allowances for residents across the UK:

-

NIC Cuts: A Silver Lining for Freelancers, But Is It Enough?

The recent National Insurance Contribution (NIC) cuts offer some relief for freelancers, but the picture isn't entirely rosy.