Resources

Categories

-

Travel expense relief for hybrid workers

The pandemic changed the way in which many people worked,

-

Company Trivial Benefits

Trivial benefits have their own tax exemption, which if used wisely can be used to treat employees.

-

Optimal salary for 2023/24

A popular profit extraction strategy is to pay a small salary and to extract further profits as dividends.

-

Dividends in 2023/24

From 6 April 2023, the dividend allowance is to fall to £1,000.

-

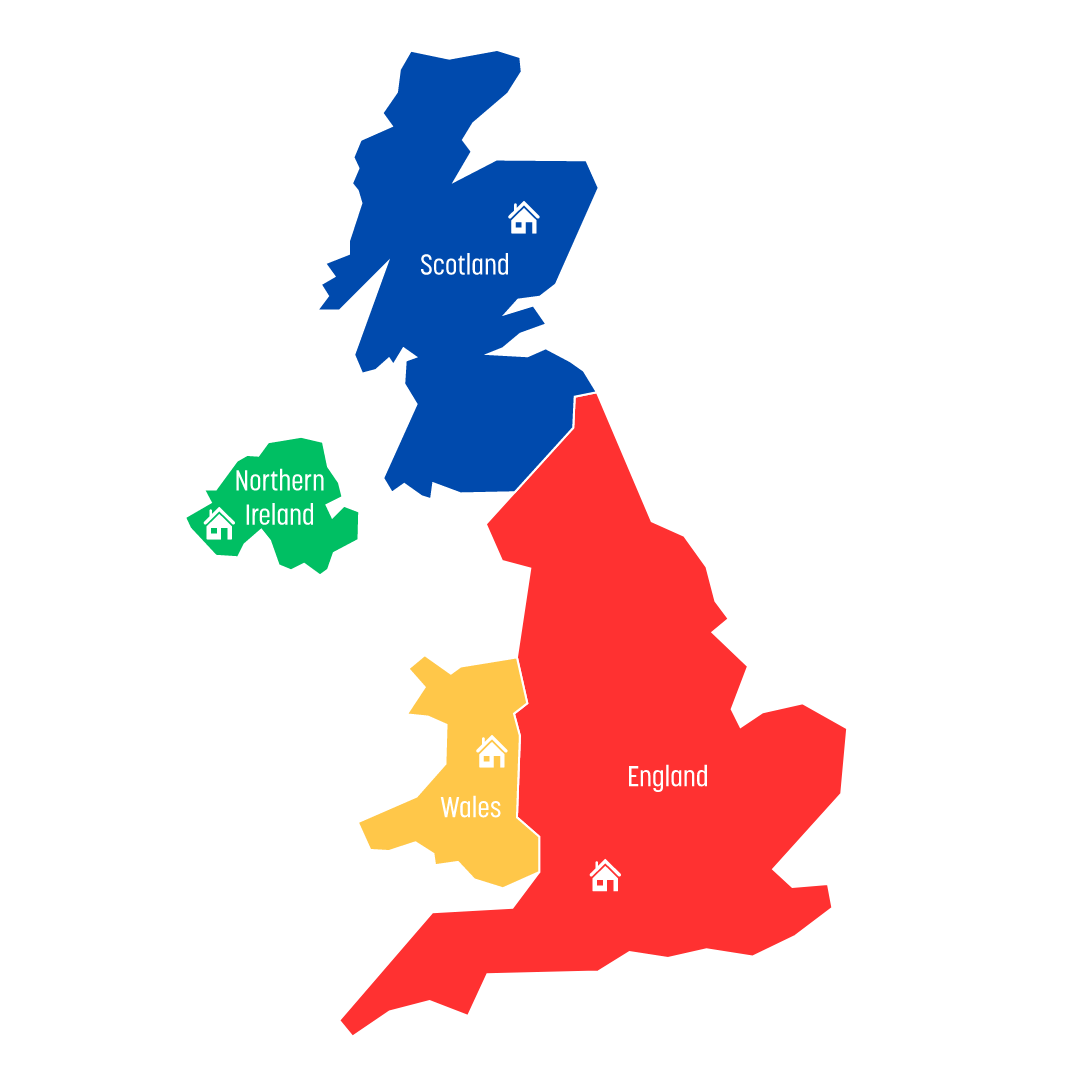

SDLT, LBTT and LTT hit of buying an investment property

Where a property is purchased in England or Northern Ireland and the consideration exceeds the relevant threshold, stamp duty land tax will be payable.

-

Client & staff business entertaining

Many businesses view entertaining clients and customers to be an important part of their marketing budgets

-

New corporation tax regime

Corporation tax is being reformed from 1 April 2023.