Resources

Categories

-

Launching Your Business Without Breaking the Bank: Claiming Pre-Trading Expenses

Starting a business is exciting, but it can also come with a mountain of pre-launch expenses.

-

Don't Let Losses Drag You Down: Tax Relief for Freelancers & Small Businesses

Running your own show is rewarding, but sometimes even the most dedicated entrepreneurs face a tough year.

-

Freelancers: Can You Write Off Meals with Clients?

Running your own business means keeping costs down.

-

Lost Years, Lost Credit: Why Registering for Child Benefit Matters

A recent scandal has revealed a hidden pitfall for parents who choose not to claim child benefit: potential loss of state pension credit in retirement.

-

Good News for Self-Employed Training Costs!

Just starting your own business? Great decision! As a new freelancer or sole trader, you might be wondering if you can claim tax relief for training courses.

-

Changes to Child Benefit for Higher Earners: What You Need to Know

Are you a family getting Child Benefit and one partner earns a good income?

-

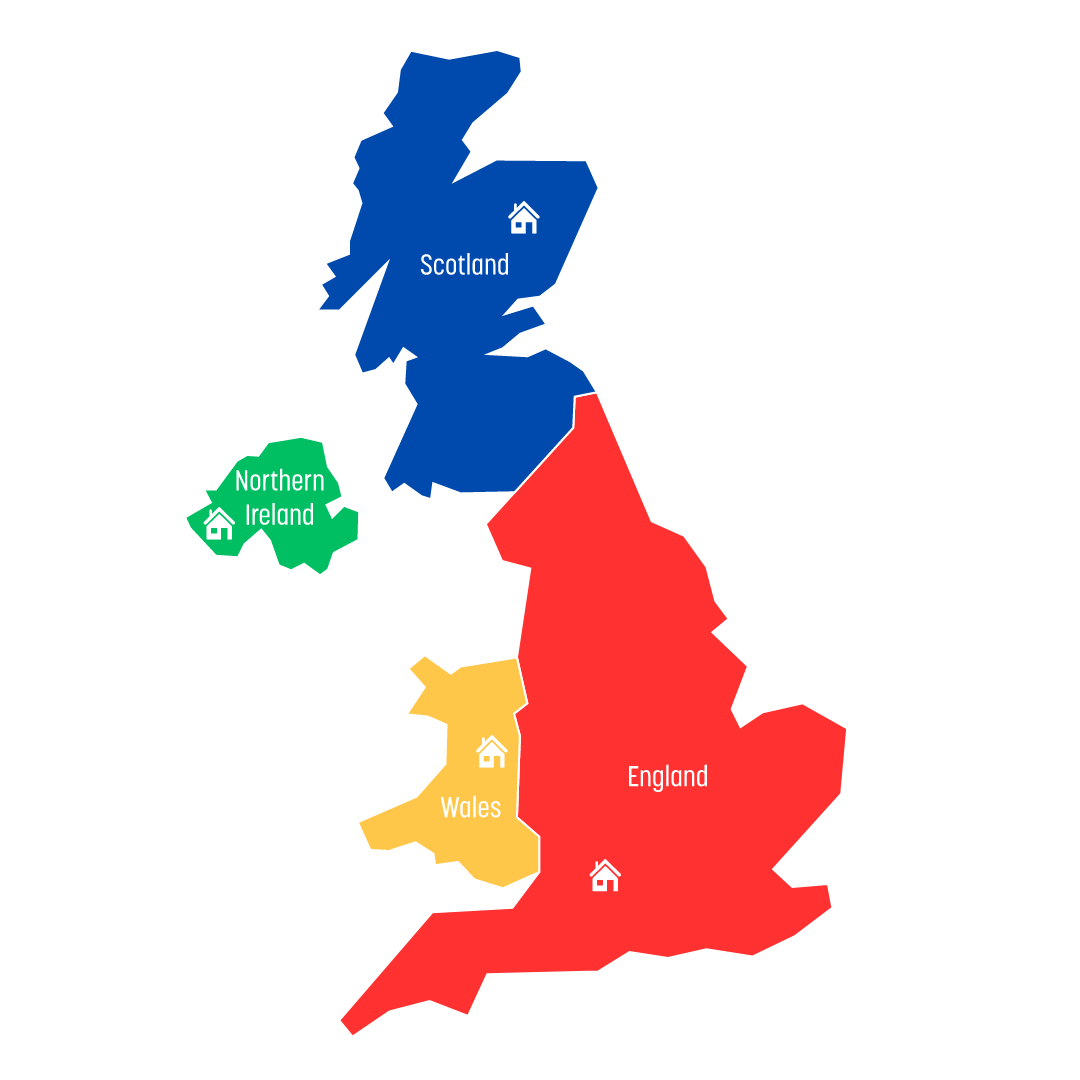

Income Tax Rates and Allowances for 2024/25 (UK)

Here's a breakdown of income tax rates and allowances for residents across the UK:

-

NIC Cuts: A Silver Lining for Freelancers, But Is It Enough?

The recent National Insurance Contribution (NIC) cuts offer some relief for freelancers, but the picture isn't entirely rosy.

-

Companies House Fees to Increase: What You Need to Know

Companies House is raising its fees starting May 1st, 2024.

-

Recommended 2024/25 Salary

Salary Sorted! Corporation tax thresholds haven't changed, so here's a quick tip to save your company some cash: