Resources

Categories

-

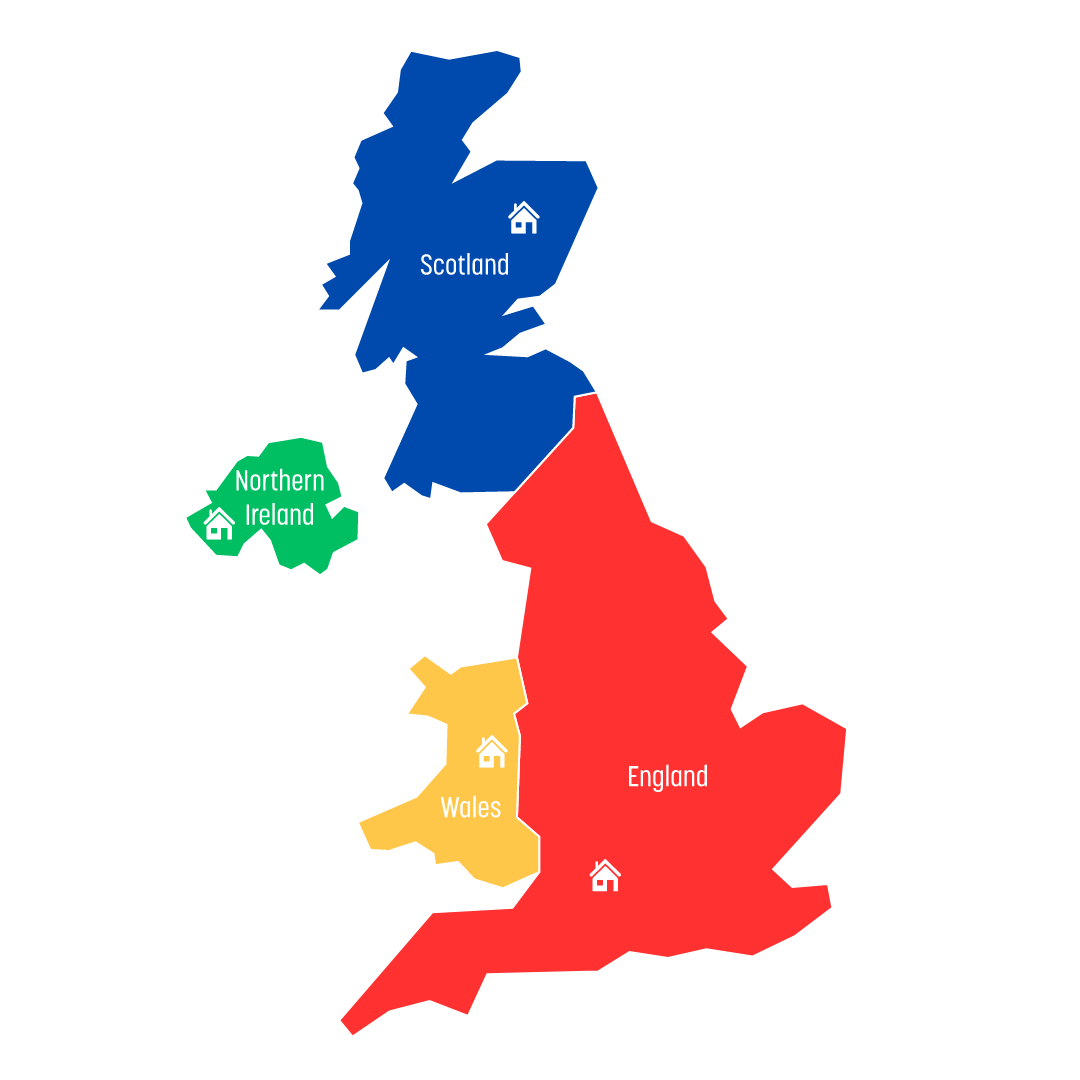

Income Tax Rates and Allowances for 2024/25 (UK)

Here's a breakdown of income tax rates and allowances for residents across the UK:

-

NIC Cuts: A Silver Lining for Freelancers, But Is It Enough?

The recent National Insurance Contribution (NIC) cuts offer some relief for freelancers, but the picture isn't entirely rosy.

-

Companies House Fees to Increase: What You Need to Know

Companies House is raising its fees starting May 1st, 2024.

-

Recommended 2024/25 Salary

Salary Sorted! Corporation tax thresholds haven't changed, so here's a quick tip to save your company some cash:

-

How New Tax Ruling Affects Small Businesses Using Double-Cab Pickups

Attention small business owners who use double-cab pickups!

-

Ditch the Spreadsheet Struggle, Freelancers! Embrace Cloud Accounting Bliss

Thinking of moving from desktop accounting software to the cloud?

-

Drumroll please... It's Tax Season 2024!

Don't let the filing frenzy faze you. Get ready with us!

-

Heat Pump Incentives: Home or Business, Which Grant Saves You More?

Navigating the options can be tricky, lets look at the main two key schemes

-

Paternity Leave Gets Flexible: How the 2024 Changes Impact Self-Employed Parents

For self-employed parents in the UK, the arrival of a new child means not just joy, but also a juggling act of responsibilities and income.

-

ISA vs Pension: Navigating the Savings Maze for Freelancers and the Self-Employed

A comprehensive guide to navigating the ISA vs pension debate for freelancers and the self-employed. Remember, knowledge is power, and informed financial decisions can lead to a secure and fulfilling future.